To paraphrase the revolutionary patriot, Thomas Paine: “These are the times that try investor’s soul.” Without a doubt, I believe the past couple of months have been among the worst that I have witnessed in quite some time. I recognize the importance of staying in touch with clients, especially during moments of uncertainty, as fear can be a powerful force that can propel smart people to make bad decisions. After all, it is only human to react emotionally to the plethora of negative news and fear mongers, especially when our money is on the line. Moreover, many peeps still cannot shake the memory of the stock market crash of 2008. Regrettably, history has proven that during times of apprehension, anxiety, and discomfort, folks often lose faith in the stock market, subsequently wave the white flag, and dump their holdings. In other words, we allow the talking heads to convince us to give up on our long-term strategy and to follow their doomsday forecast. Yes indeed, many investors may have been manipulated during times of volatility!

I find it amusing when the financial press assigns a culprit for the reason to panic. For example, back in May the offender was Greece. A little over a year ago, the perpetrator was Ebola, and before that, it was the fiscal cliff and Obama’s re-election. The current antagonist is China and its slowing economy, along with the Fed’s indecision on raising interest rates. I steadfastly argue that all the gnashing of teeth about the Fed seems like a huge waste of time. I give virtually no attention to the apparent “cause” of the decline in stocks; as I consider the drops, especially the larger ones, have more to do with investor psychology than it does with anything else.

Please understand that I am not suggesting, in the least, that I have all of the correct answers or that you should only follow my advice, instead I encourage you to listen to the other side. However, we must strap on our “nonsense filters” and employ common sense! As I am sure you will agree, opinions are the cheapest commodities on Earth. Nobody has a shortage of views to share with us if we are willing to listen and perhaps accept them. Nevertheless, our baloney screens and common sense reminds us that fear sells, and that is what media often enjoys parading in front of us.

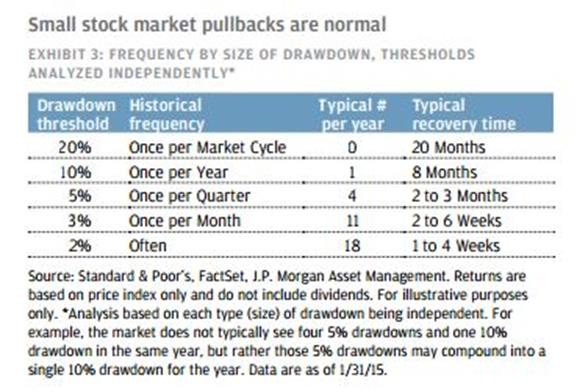

I encourage you to cut out the chart, tape it to your refrigerator, and more importantly refer to it often. I trust that you will arrive at the same conclusion as your humble columnist, yes; these declines are painful, but they are normal and expected. Therefore, I believe there is no reason to panic. However, I know for many folks, that it is easier to say than do. Staying calm and disciplined with our long-term investment strategy during so-called “crisis” time takes a lot of work. It is very simple, but simple is not easy.

Although periodic “predicaments” are inevitable, the good news is that recovery and potentially higher stock prices could be on the horizon! Certainly, nothing is certain. That is the only certain thing that there is! Nevertheless, I do not expect this time to be any different! Finally, please remember that what we do not know arguably does not hurt us. Instead, we get hurt by what we know and do not do. If we want to succeed in investing, we must stop thinking someone has a crystal ball to the market. Nobody does. Your educated guess is as good as anyone’s! What is far more important than soothsaying is to believe that certain fundamental principles have historically endured, diversification*, discipline, consistency and the value of experienced advising. I believe we must automate our investment strategy as much as possible and simply get out of the way. But then again what do I know. I am just a curmudgeon with an opinion!

Harry Pappas Jr., CFP®, CDFA™

Managing Director-Investments

Certified Estate and Trust Specialist

Pappas Wealth Management Group of Wells Fargo Advisors

818 A1A N, Ste. 200

Ponte Vedra, Florida 32082

904-273-7955

harry.pappas@wellsfargoadvisors.com

The use of the CDFA™ designation does not permit Wells Fargo Advisors or its Financial Advisors to provide legal advice, nor is it meant to imply that the firm or its associates are acting as experts in this field. Wells Fargo Advisors LLC, Member SIPC, is a Registered Broker-Dealer and a separate non-bank affiliate of Wells Fargo & Company.

* Diversification does not guarantee profit or protect against loss in declining markets.

This and/or the accompanying statistical information was prepared by or obtained from sources that Wells Fargo Advisors believes to be reliable, but its accuracy is not guaranteed. The report herein is not a complete analysis of every material fact in respect to any company, industry or security. The opinions expressed here reflect the judgment of the author as of the date of the report and are subject to change without notice.

Any market prices are only indications of market values and are subject to change. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.